how much tax is taken out of my first paycheck

If you want to shelter more of your Florida earnings from a federal tax bite you can max out your 401k so that more of your paycheck is going to tax-advantaged retirement savings. So what you are really asking is why is federal income tax withholding more than 212 of my paycheck.

How To Read Your Paycheck Arkansas Next

I verified with accounting my married and 8 withholding was the same tax scenario for both months.

. Social Security tax is 62 double that is self-employed Medicare tax is 145 ditto. Assuming that you are in the US. IR-2019-178 Get Ready for Taxes.

Texas tax calculator spits out 900 something is what the fed tax should have been. Plus Federal Income tax and State Income tax sometimes city or county tax too. Total annual income - Tax liability All deductions Withholdings Your annual paycheck.

For example for the 2012 tax year single filers paid a 10 percent federal income tax on the first 8700 of taxable income. First she will automatically receive a standard deduction 5950 for tax year 2012 and possibly other tax credits when she completes her tax return. For example if you earn 200 per month and you are deducted 32.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Get ready today to. We have a progressive income tax structure in the US.

With the 2019 tax code 62 of your income goes toward social security and 29 goes toward medicare tax but if youre employed by a company full-time they pay half of your medicare responsibilities so you should only see 145 taken from. Grossed 7100 last check of last year fed tax was 900 something roughly 13 then grossed 6900 for the first month of this year fed tax is 1726 25. Your FICA tax social security medicare is 765 of your paycheck.

I dont know where you live but if youre in a state with a st. There are a number of ways through which you can find out the amount of money deducted from your paycheck for taxes. You can also contribute to a tax-free FSA or HSA to use for medical expenses.

It said that a total of 22 of my income was taken out. Use tab to go to the next focusable element. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might move into. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. The amounts taken out of your paycheck for social security and medicare are based on set rates.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. Taxable income Tax rate based on filing status Tax liability. However you only pay half of this amount or 62 out of your paycheck -- the other half is paid by your employer.

22 taxes and other deductions is about right for. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Its possible that too much is being withheld currently but thats an easy fix to make.

The Social Security tax rate in the United States is currently 124. In the steps showing how to figure out net pay. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit.

This is because they have too much tax withheld from their paychecks. The TCJA eliminated the personal exemption. My first couple paychecks have been kinda strange.

It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. These are rolled together as FICA for 7625 of gross paycheck. 1592 every two weeks is 41392 or 309 which is probably about right counting 765 for FICA and the rest for statefed income tax.

800 me my wife and two. In effect taxpayers who get refunds are giving the IRS an interest-free loan of their money. You can simply calculate the percentage tax deducted from your pay by multiplying the total amount of tax deductions by a hundred and then dividing by your salary.

The Withholding Form. Tax brackets range from 10 percent to 37 percent of your taxable income. The average taxpayer gets a tax refund of about 2800 every year.

My first check was over 400 I worked 40 for one week and only 30 was taken out for state tax and other taxes. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Need to complete this and the remaining sections the first time you use.

I have a little bit of state tax taken out and some social security and whatnot but the last couple times have NO federal tax taken out. Enter your wage hours and deductions and this net paycheck calculator will instantly estimate your take-home pay after taxes and deductions 2022 rates. You can find 2021 tax brackets here 3B.

Answer 1 of 3. If youre paid biweekly you are paid 26 times a year.

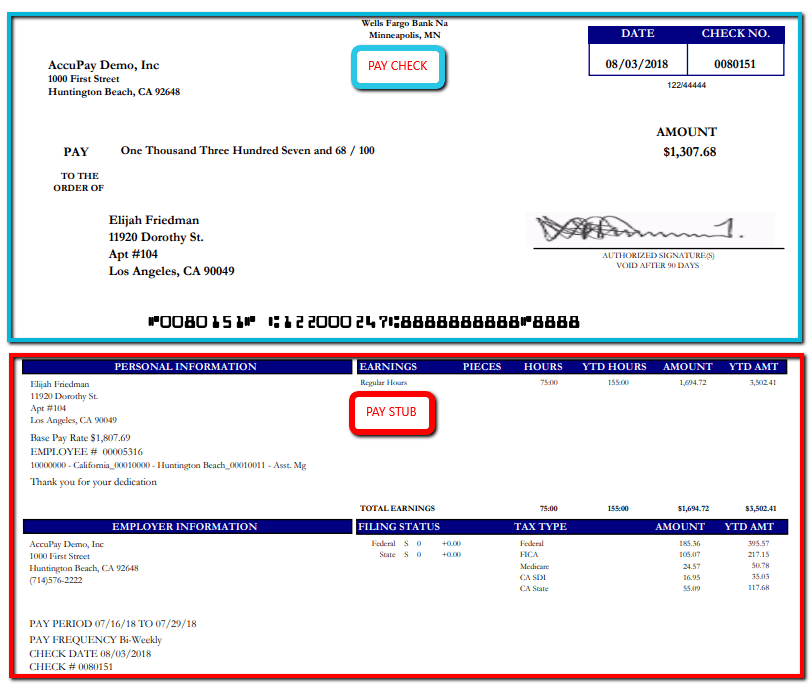

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Different Types Of Payroll Deductions Gusto

Paycheck Calculator Online For Per Pay Period Create W 4

My Job Is Taking 20 Of My Paycheck To Federal Taxes I M A Minor 14 Is That Too High Quora

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com

Understanding A Paycheck And Pay Stub Quiz Quizizz

Why I Use The 50 30 20 Formula Personal Finance Budgeting Money Finance

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Independent Contractor

The 50 20 30 Budget Budgeting Budgeting Finances Budgeting Money

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Themint Org Tips For Teens Decoding Your Paycheck