cayman islands tax residency certificate

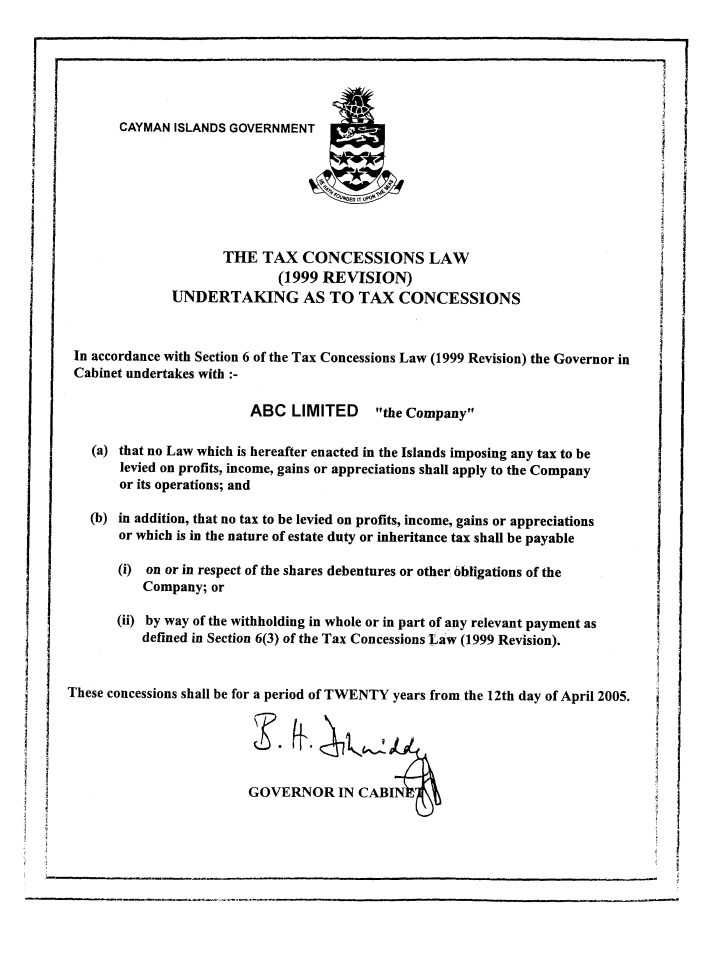

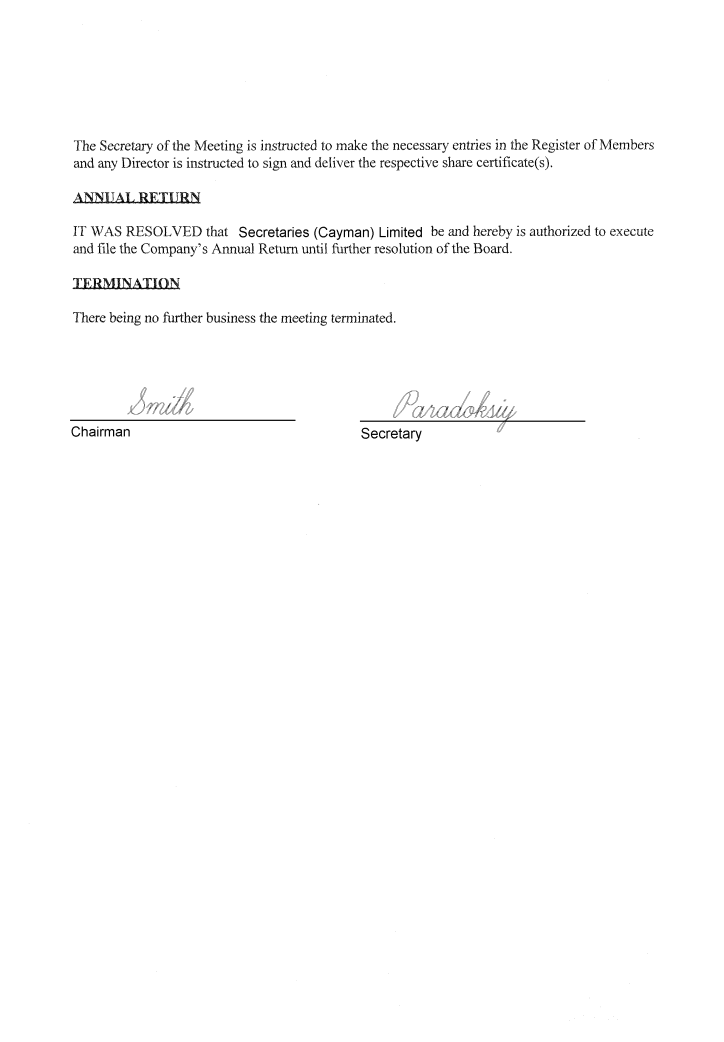

Web Corporate - Corporate residence. Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands.

This may be relevant or desirable for.

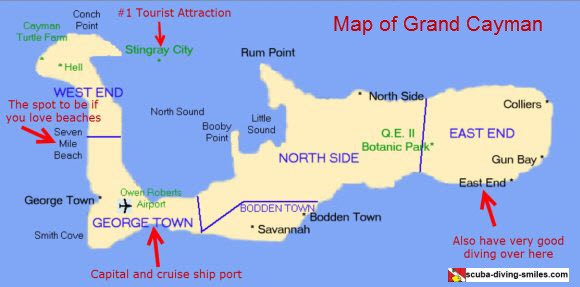

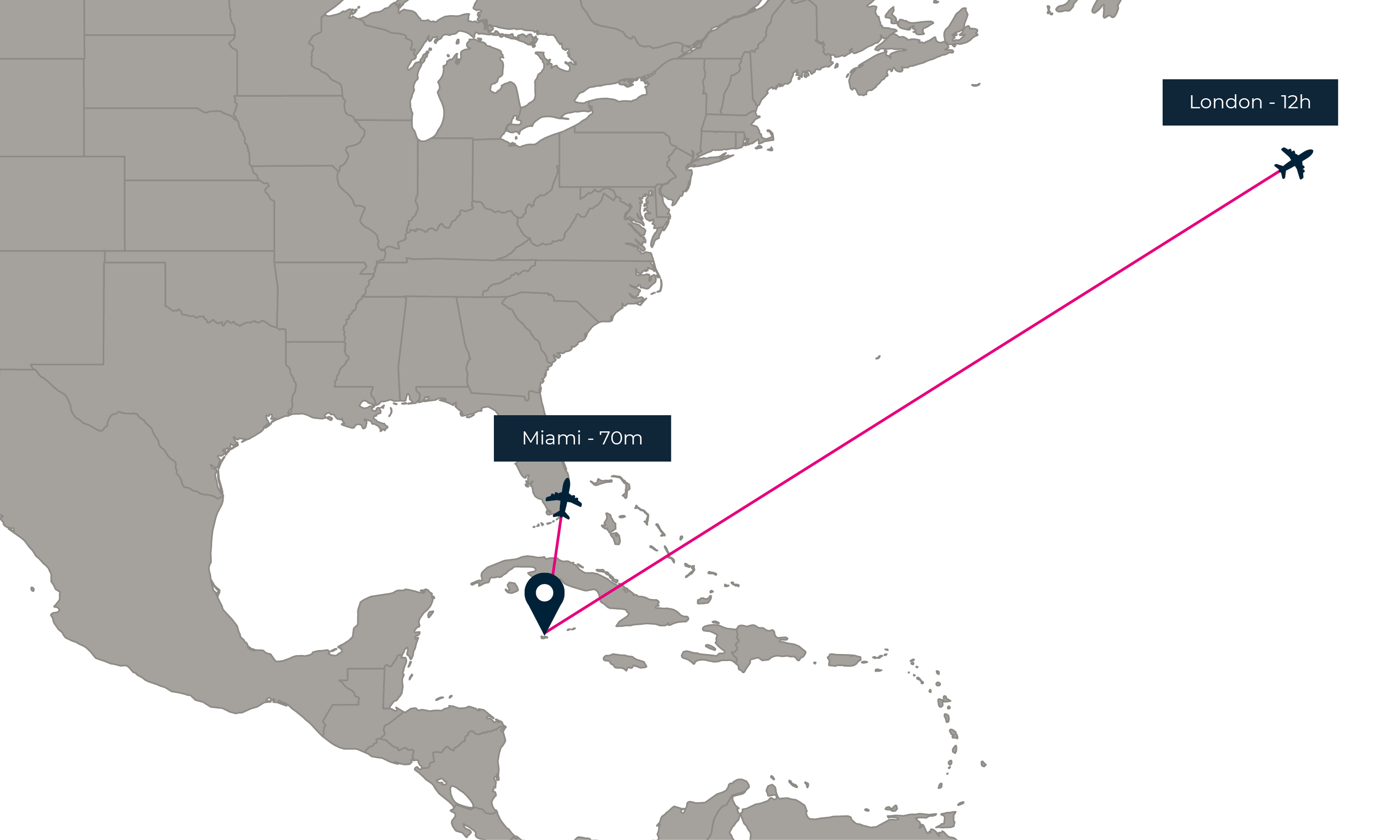

. Web To apply for a Residency Certificate Persons of Independent Means visa you must provide evidence of a regular source of income of 150000 USD or more. Web The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. Web Individual - Residence Last reviewed - 04 August 2022 The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily.

CI1000 per dependent issuance. Web Last updated 02 February 2022. Web When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your.

Fees are payable At the time of submitting an application 1000. Web Residency Certificate for Persons of Independent Means. Web A Residency Certificate Substantial Business Presence is available to individuals who either own at least a 10 share in an approved category of business or.

Web Residency Certificate of Substantial Business Presence Fees. Web Any person who has been legally and ordinarily resident in the Cayman Islands for at least eight years but not more than nine years other than the holder of a. Web The fee to apply for a Certificate of Permanent Residence for Persons of Independent Means is CI500 US60975.

CI500 US610 CI20000 US24400 CI1000 US1220 per annum. Web The surviving or former spouse may within a period of three months of any revocation apply for the grant of a Residency Certificate for Persons of Independent Means in their own. Web It is interesting to note that the IRD is only prepared to issue a Hong Kong tax residency certificate for a year in which the applicant has recognised the relevant income ie.

If the application is approved there is a one. For foreign nationals not wishing to work in the Cayman Islands but simply wishing to have the right to reside there are alternative. Web This Certificate is valid for 25 years and is renewable and entitles the holder and any qualifying dependents to reside in the Cayman Islands and work in the business in which.

Web ² A Residency Certificate Substantial Business Presence may be varied to add or remove dependants. CI500 US610 Certificate of Permanent. Web A Certificate of Permanent Residence for Persons of Independent Means may be granted to persons who invest at least two million Cayman Islands Dollars in developed real estate.

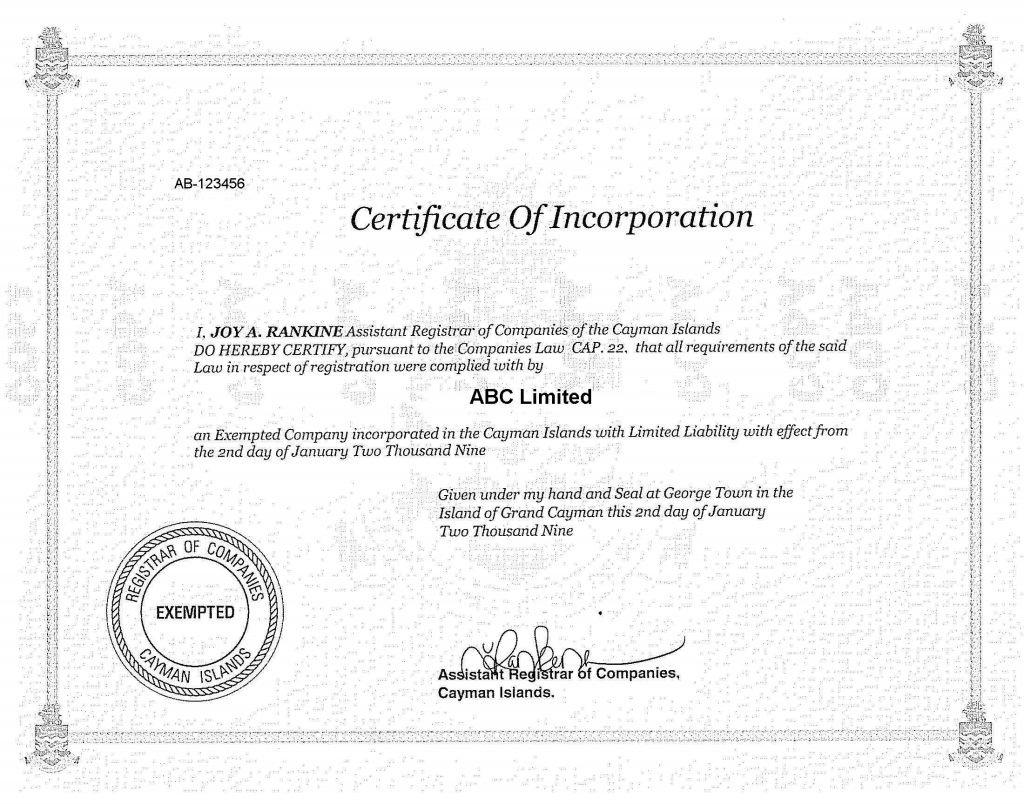

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

Cayman Islands Citizenship By Investment Cayman Islands Pr

Fillable Online Person Married To A Caymanian Cayman Islands Immigration Bb Fax Email Print Pdffiller

Cayman Islands Non Resident Company Formation And Benefits

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

The Cayman Islands Residency By Investment Programme Latitude

Learn More About Cayman Islands Residency And Citizenship Privacy World

The Many Residency By Investment Options In The Cayman Islands

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

Tax Residency In Low Tax Jurisdictions To Legally Reduce Taxes Flag Theory

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

Buying Property In The Cayman Islands 7th Heaven Properties

Cayman Islands Fatca And Common Reporting Standard Deadlines

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

The Many Residency By Investment Options In The Cayman Islands

Cayman Resident 2021 By Acorn Media Issuu

Tax Residency In Low Tax Jurisdictions To Legally Reduce Taxes Flag Theory